De novo bank boom hindered by elevated capital requirements

Navigating the New Canadian Derivatives Landscape: Key Changes and Compliance Steps for 2025

Getting an Edge with Services: Driving optimization by embracing technological innovation

Banking Essentials Newsletter: August 21st Edition

The Four Steps of Effective Due Diligence

Ever-rising capital demands, driven by increased technology and talent expenses and higher capital requirements from regulators, are dampening the prospects of some de novo bank hopefuls.

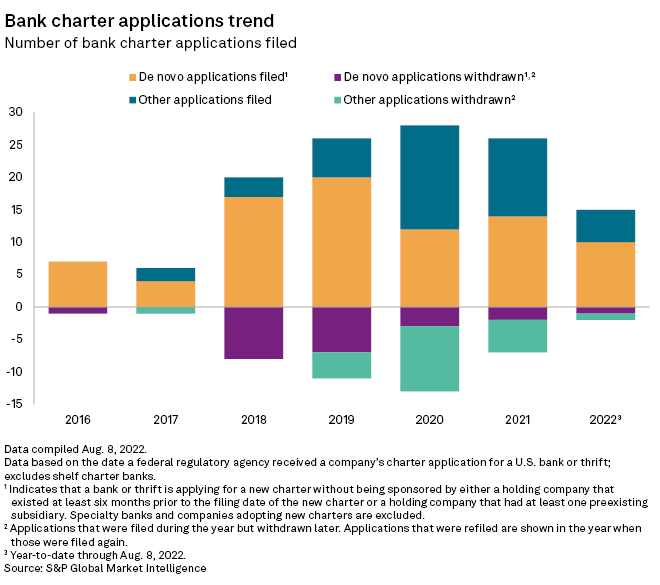

For the third consecutive year, the number of de novo applications is on track to fall short of levels seen in 2018 and 2019. Just 10 de novo applications have been filed thus far in 2022, according to S&P Global Market Intelligence data, compared to 17 applications in all of 2018, 20 applications in 2019 and the hundreds of applications filed in the years prior to the Great Recession.

"I think you can tell by the number of de novos that have been successfully completed in the last handful of years that the environment is challenging," Andrew Christians, a managing director at Donnelly Penman & Partners Inc., said in an interview.

More money, more problems

Regulators have heightened capital requirements for new banks while tightening their scrutiny more generally.

"The regulators have made it a bit more difficult for de novos on two levels," said Michael Waters, a partner at Jones Walker LLP. "The regulators are a little bit stricter right now about new bank formations in terms of just how they review the application, the experience of the potential management [and] the previous experience that proposed directors have had on bank boards."

At the same time, the costs of forming a de novo have also started to limit activity.

"What's changed is that stuff costs more," James Stevens, a partner at Troutman Pepper Hamilton Sanders LLP, said in an interview, citing the cost of employees, along with the software and technology to maintain both a physical and online banking presence. "It costs a lot to maintain it and keep up with the trends, so I think that what we've seen is that there's more capital that people are required [to raise] to form banks, but it's not necessarily because of the regulators, it's because it costs more."

As a result, some de novo organizers have struggled to meet higher requirements.

"They think they can do it themselves and they'll run into a wall at typically about somewhere between $5 [million] and $10 million," said Greg Cunningham, senior vice president of financial institutions at Donnelly Penman & Partners.

How much capital do de novos need?

The minimum amount of capital needed to fund a new bank is $20 million, according to multiple de novo advisers.

"The amount of capital typically needed is maybe 30% to 50% more than the capital that had been needed before the [Great] Recession," said Neil Grayson, a partner with Nelson Mullins Riley & Scarborough LLP.

The costs of opening a de novo often depend on location, according to Steven Lanter, a partner at Luse Gorman PC. "If you're starting a bank in Washington, D.C., versus rural Missouri, just because the cost of the assets and the credits, in all likelihood you're going to have to raise more money to start a bank that's viable in Washington, D.C.," Lanter said.

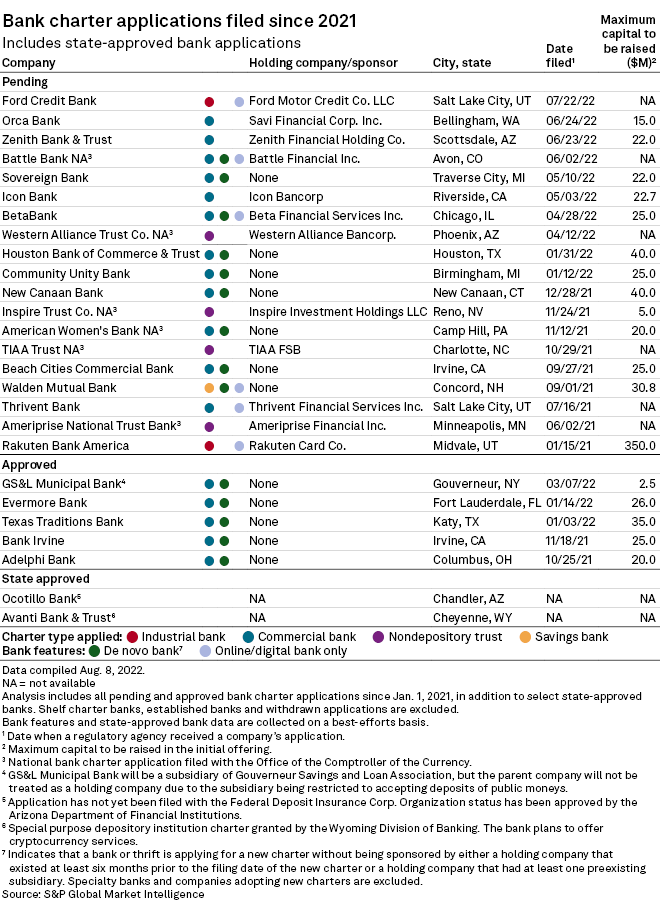

Of the five de novo banks that applied for deposit insurance between Jan. 1, 2021, and Aug. 8, 2022, and received approval, four have plans to raise more than $20 million in capital in their initial offering. Of the other nine applicants during that time frame that are still pending approval, eight disclosed the maximum amount of capital to be raised in the initial offering. All eight said they plan to raise at least $20 million.

The downside, and upside, of uncertainty

The cloudy macroeconomic picture presents another hurdle.

"Anybody that's trying to raise capital has a harder time raising capital in periods of uncertainty, and I think that right now there's a lot of uncertainty," Stevens said. "[Investors are] sort of are less inclined to invest in new ventures in that environment."

On the other hand, some investors may see de novos as an attractive investment during a period of uncertainty. New financial institutions can benefit from being able to pick and choose their assets, bypassing the challenging economic conditions, Lanter said.

In some cases, market demand for a de novo bank can supersede any worries over macroeconomic issues. If a community is "thirsty for a new bank," those involved in launching a de novo are unlikely to be deterred by inflation or whether a recession is on the horizon, Stevens said.

Ultimately, the investors contributing capital to de novos play a central role in determining success or failure for a fledgling bank.

"The people that are involved in de novos and the markets in which they serve are going to be two of the biggest indications as to whether or not the de novo will be successful in opening and raising capital," Cunningham said.